All Categories

Featured

Table of Contents

This is regardless of whether the insured individual passes away on the day the plan begins or the day prior to the policy ends. A degree term life insurance plan can suit a large array of circumstances and demands.

Your life insurance policy policy can also form part of your estate, so might be based on Estate tax read more about life insurance coverage and tax - Level premium term life insurance. Let's look at some features of Life insurance policy from Legal & General: Minimum age 18 Optimum age 77 (Life insurance policy), or 67 (with Important Disease Cover)

The quantity you pay remains the very same, yet the degree of cover decreases about in line with the way a payment home loan lowers. Lowering life insurance can help your loved ones remain in the household home and avoid any further interruption if you were to pass away.

If you select level term life insurance, you can allocate your costs due to the fact that they'll remain the same throughout your term. Plus, you'll know exactly just how much of a survivor benefit your beneficiaries will receive if you pass away, as this quantity will not transform either. The rates for degree term life insurance policy will depend upon numerous factors, like your age, health status, and the insurance policy company you select.

Once you go through the application and clinical test, the life insurance firm will review your application. Upon authorization, you can pay your first premium and sign any type of appropriate documents to guarantee you're covered.

What Exactly Is Decreasing Term Life Insurance Coverage?

Aflac's term life insurance policy is hassle-free. You can pick a 10, 20, or thirty years term and enjoy the included assurance you deserve. Functioning with an agent can help you discover a plan that functions best for your needs. Find out more and obtain a quote today!.

As you seek means to secure your economic future, you have actually likely encountered a variety of life insurance alternatives. Picking the ideal insurance coverage is a huge choice. You wish to discover something that will aid sustain your loved ones or the reasons essential to you if something takes place to you.

What is Level Term Life Insurance? Comprehensive Guide

Many people lean towards term life insurance for its simplicity and cost-effectiveness. Degree term insurance coverage, nonetheless, is a type of term life insurance policy that has consistent repayments and an unvarying.

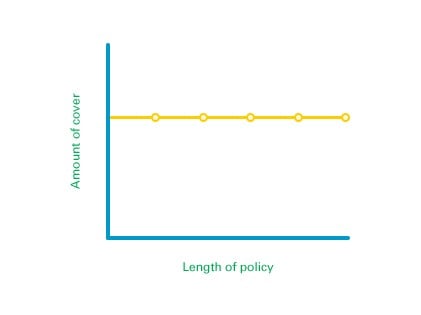

Level term life insurance policy is a subset of It's called "level" due to the fact that your costs and the advantage to be paid to your loved ones continue to be the exact same throughout the contract. You will not see any changes in cost or be left questioning its value. Some contracts, such as annually sustainable term, might be structured with costs that increase over time as the insured ages.

Dealt with fatality advantage. This is also set at the start, so you can recognize exactly what fatality benefit amount your can anticipate when you pass away, as long as you're covered and updated on premiums.

You agree to a set costs and death advantage for the duration of the term. If you pass away while covered, your death advantage will certainly be paid out to enjoyed ones (as long as your costs are up to date).

An Introduction to Joint Term Life Insurance

You may have the alternative to for one more term or, extra most likely, restore it year to year. If your contract has an ensured renewability provision, you might not need to have a brand-new medical examination to maintain your insurance coverage going. However, your premiums are most likely to boost since they'll be based upon your age at revival time.

With this alternative, you can that will certainly last the remainder of your life. In this situation, once more, you might not need to have any type of new medical examinations, however costs likely will rise because of your age and new insurance coverage (Level premium term life insurance policies). Various firms offer numerous choices for conversion, make sure to understand your selections before taking this action

Speaking to a financial expert also may assist you determine the course that straightens finest with your total strategy. The majority of term life insurance is level term for the duration of the agreement duration, but not all. Some term insurance may come with a costs that boosts with time. With lowering term life insurance, your survivor benefit goes down gradually (this kind is commonly gotten to especially cover a long-term financial obligation you're settling).

And if you're established for sustainable term life, after that your costs likely will increase annually. If you're discovering term life insurance policy and intend to ensure straightforward and foreseeable economic defense for your family members, level term may be something to think about. As with any kind of type of coverage, it might have some restrictions that don't satisfy your needs.

What Does What Is Direct Term Life Insurance Mean for You?

Generally, term life insurance is a lot more affordable than irreversible insurance coverage, so it's an affordable method to secure financial protection. At the end of your agreement's term, you have numerous options to proceed or move on from insurance coverage, typically without requiring a clinical test.

Just like other kinds of term life insurance policy, when the agreement finishes, you'll likely pay greater premiums for insurance coverage since it will certainly recalculate at your existing age and wellness. Repaired insurance coverage. Degree term uses predictability. If your economic circumstance changes, you might not have the essential coverage and may have to acquire added insurance.

However that doesn't suggest it's a fit for everyone (Term life insurance for spouse). As you're going shopping for life insurance policy, here are a couple of key factors to take into consideration: Budget plan. Among the advantages of degree term protection is you know the cost and the survivor benefit upfront, making it much easier to without fretting about rises over time

Age and health. Usually, with life insurance policy, the healthier and younger you are, the even more affordable the coverage. If you're young and healthy and balanced, it might be an appealing option to secure low premiums now. Financial duty. Your dependents and economic duty contribute in determining your coverage. If you have a young family, for instance, degree term can assist supply financial backing throughout critical years without spending for coverage longer than necessary.

Table of Contents

Latest Posts

Final Burial Expenses

Funeral Insurance Compare

Burial Insurance For Senior

More

Latest Posts

Final Burial Expenses

Funeral Insurance Compare

Burial Insurance For Senior