All Categories

Featured

Table of Contents

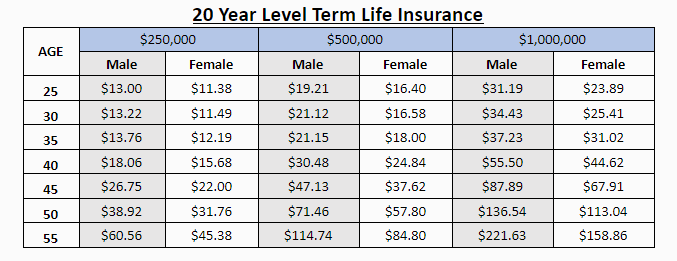

If you pick level term life insurance policy, you can allocate your premiums due to the fact that they'll remain the same throughout your term. And also, you'll recognize specifically just how much of a survivor benefit your recipients will get if you die, as this quantity won't change either. The prices for degree term life insurance policy will depend on a number of elements, like your age, wellness status, and the insurance firm you select.

As soon as you go through the application and medical examination, the life insurance policy company will evaluate your application. They must educate you of whether you have actually been authorized soon after you use. Upon authorization, you can pay your first costs and sign any appropriate documentation to guarantee you're covered. From there, you'll pay your premiums on a monthly or yearly basis.

Aflac's term life insurance policy is hassle-free. You can choose a 10, 20, or three decades term and enjoy the included comfort you are entitled to. Collaborating with an agent can assist you locate a policy that works ideal for your needs. Discover much more and get a quote today!.

As you look for ways to protect your economic future, you've most likely come across a wide array of life insurance alternatives. term life insurance for couples. Picking the appropriate protection is a big choice. You wish to discover something that will certainly help sustain your enjoyed ones or the causes crucial to you if something takes place to you

Several individuals lean toward term life insurance policy for its simpleness and cost-effectiveness. Level term insurance policy, nonetheless, is a kind of term life insurance that has consistent repayments and an imperishable.

Guaranteed Issue Term Life Insurance

Level term life insurance policy is a subset of It's called "degree" due to the fact that your costs and the benefit to be paid to your enjoyed ones continue to be the same throughout the contract. You won't see any modifications in price or be left questioning its worth. Some contracts, such as each year renewable term, may be structured with premiums that increase with time as the insured ages.

Taken care of death advantage. This is likewise set at the start, so you can know specifically what fatality benefit amount your can anticipate when you pass away, as long as you're covered and up-to-date on costs.

You agree to a set premium and death advantage for the period of the term. If you pass away while covered, your death benefit will certainly be paid out to loved ones (as long as your costs are up to date).

You might have the choice to for an additional term or, most likely, renew it year to year. If your agreement has actually an assured renewability condition, you might not require to have a brand-new medical examination to keep your insurance coverage going. Your costs are most likely to raise due to the fact that they'll be based on your age at renewal time.

With this option, you can that will last the rest of your life. In this instance, once more, you may not need to have any kind of brand-new clinical tests, but costs likely will climb because of your age and new coverage. group term life insurance tax. Different firms offer various choices for conversion, be sure to comprehend your options before taking this action

Coverage-Focused Which Of These Is Not An Advantage Of Term Life Insurance

Consulting with a monetary consultant likewise might help you figure out the course that aligns ideal with your general method. Many term life insurance coverage is level term throughout of the agreement duration, yet not all. Some term insurance might include a premium that increases in time. With decreasing term life insurance, your fatality benefit goes down with time (this kind is usually taken out to particularly cover a long-term debt you're paying off).

And if you're set up for eco-friendly term life, then your premium likely will rise every year. If you're discovering term life insurance policy and intend to ensure simple and predictable financial defense for your household, level term may be something to think about. As with any kind of type of insurance coverage, it might have some restrictions that don't fulfill your needs.

Family Protection Level Term Life Insurance Definition

Usually, term life insurance is more cost effective than irreversible coverage, so it's a cost-efficient method to safeguard financial protection. Adaptability. At the end of your agreement's term, you have numerous choices to proceed or go on from coverage, usually without requiring a medical examination. If your budget or protection requires change, fatality advantages can be lowered gradually and lead to a lower costs.

Just like other sort of term life insurance policy, as soon as the contract finishes, you'll likely pay greater premiums for coverage due to the fact that it will recalculate at your present age and health. Dealt with coverage. Degree term offers predictability. If your economic circumstance adjustments, you may not have the needed insurance coverage and may have to buy extra insurance.

Yet that doesn't indicate it's a fit for every person. As you're buying life insurance, here are a couple of essential factors to consider: Budget. Among the benefits of level term protection is you understand the price and the fatality benefit upfront, making it easier to without fretting about boosts over time.

Age and wellness. Usually, with life insurance policy, the healthier and younger you are, the more budget friendly the insurance coverage. If you're young and healthy and balanced, it might be an attractive choice to secure reduced costs currently. Financial responsibility. Your dependents and financial obligation play a role in determining your insurance coverage. If you have a young family, as an example, level term can help give economic support throughout crucial years without paying for insurance coverage longer than needed.

1 All cyclists are subject to the terms and conditions of the cyclist. Some states may vary the terms and conditions.

2 A conversion credit scores is not available for TermOne plans. 3 See Term Conversions area of the Term Series 160 Product Guide for just how the term conversion credit scores is figured out. A conversion credit rating is not offered if costs or charges for the new policy will be forgoed under the terms of a rider supplying special needs waiver benefits.

Long-Term Which Of These Is Not An Advantage Of Term Life Insurance

Plans converted within the first policy year will certainly get a prorated conversion credit rating based on terms and conditions of the plan. 4 After five years, we reserve the right to limit the long-term item offered. Term Collection products are issued by Equitable Financial Life Insurance Coverage Firm (Equitable Financial) (NY, NY) and are co-distributed by Equitable Network, LLC (Equitable Network Insurance Coverage Company of The Golden State, LLC in CA; Equitable Network Insurance Coverage Company of Utah in UT; and Equitable Network of Puerto Rico, Inc. Term Life Insurance coverage is a type of life insurance plan that covers the policyholder for a particular amount of time, which is recognized as the term. The term lengths differ according to what the specific picks. Terms normally range from 10 to three decades and boost in 5-year increments, providing level term insurance policy.

Table of Contents

Latest Posts

Final Burial Expenses

Funeral Insurance Compare

Burial Insurance For Senior

More

Latest Posts

Final Burial Expenses

Funeral Insurance Compare

Burial Insurance For Senior