All Categories

Featured

Table of Contents

Life insurance agents offer home mortgage protection and loan providers offer home loan defense insurance policy, at some point. do i have to have life insurance for a mortgage. Below are the 2 types of representatives that offer mortgage defense (is home insurance the same as mortgage insurance).

Getting home loan security through your lending institution is not constantly a very easy task, and most of the times quite confusing. It is feasible. Lenders commonly do not market home mortgage defense that profits you. what is mortgage disability insurance. This is where things obtain perplexing. Lenders market PMI insurance coverage which is developed to safeguard the lending institution and not you or your family members.

Best Home Buyers Protection Insurance

The letters you obtain seem originating from your lender, yet they are just coming from 3rd celebration companies. loan cover term assurance plan. If you don't end up obtaining typical home loan defense insurance coverage, there are other kinds of insurance coverage you might been needed to have or might want to take into consideration to safeguard your investment: If you have a home lending, it will be required

Particularly, you will certainly desire home coverage, contents protection and individual liability. state regulated mortgage protection plan. On top of that, you should consider including optional insurance coverage such as flooding insurance, quake insurance policy, replacement expense plus, water back-up of sewer, and other frameworks insurance coverage for this such as a gazebo, lost or unattached garage. Just as it appears, fire insurance policy is a type of building insurance that covers damages and losses caused by fire

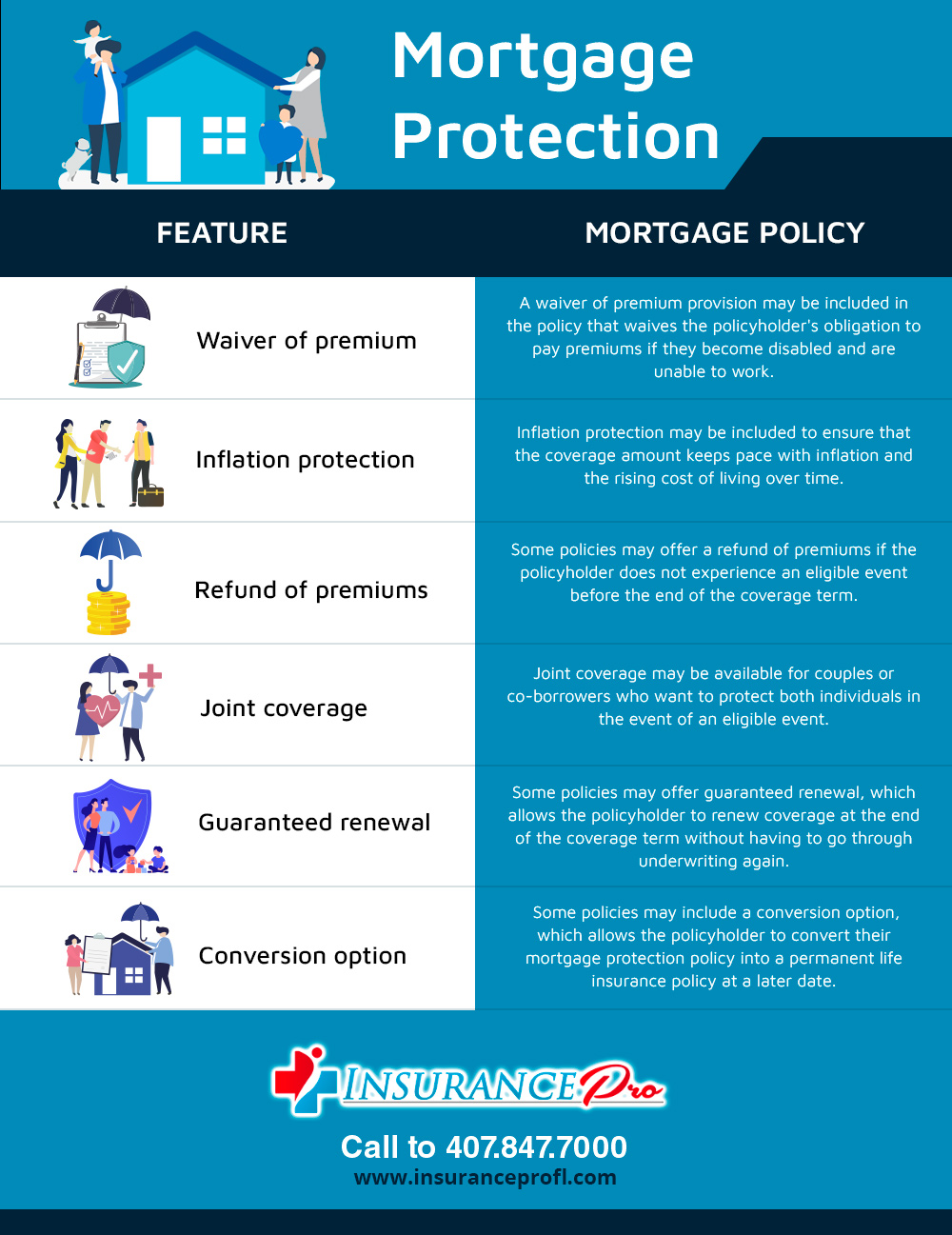

This is the key alternative to MPI insurance policy. A term policy can be structured for a certain term that pays a swelling sum upon your death which can be made use of for any type of function, including paying off your home loan. Whole life is a long-term policy that is much more costly than term insurance coverage however lasts throughout your entire life.

Coverage is normally limited to $25,000 or much less, yet it does shield against having to tap various other monetary resources when a person passes away (mortgage insurance for job loss). Last expense life insurance coverage can be used to cover medical costs and other end-of-life costs, including funeral service and funeral costs. It is a type of irreversible life insurance policy that does not end, however it is a more pricey that term life insurance policy

Life Insurance To Cover Mortgage Payments

Some funeral homes will accept the task of a final expense life insurance coverage policy and some will not. Some funeral chapels need payment in advance and will not wait till the final expense life insurance coverage policy pays. It is best to take this into consideration when dealing when taking into consideration a final expenditure in.

Benefit repayments are not assessable for revenue tax purposes. You have numerous options when it concerns purchasing home loan security insurance coverage (life and critical illness insurance mortgage). Lots of companies are very rated by A.M. Ideal, and will certainly give you the added self-confidence that you are making the right decision when you purchase a policy. Amongst these, from our point of view and experience, we have actually discovered the complying with business to be "the most effective of the most effective" when it involves issuing home loan security insurance coverage, and recommend any type of among them if they are alternatives offered to you by your insurance coverage representative or home mortgage loan provider.

How Much Is Loan Insurance

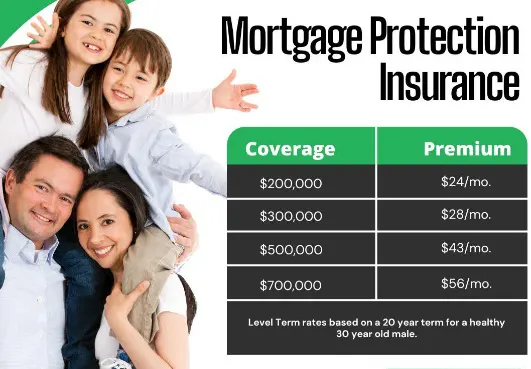

Can you obtain home loan protection insurance for homes over $500,000? The most significant difference in between mortgage protection insurance policy for homes over $500,000 and homes under $500,000 is the demand of a clinical examination.

Every business is various, yet that is a good general rule. Keeping that stated, there are a couple of firms that offer home loan security insurance approximately $1 million without any medical examinations. ppi for mortgages. If you're home is worth less than $500,000, it's extremely most likely you'll certify for plan that doesn't require clinical tests

Mortgage defense for reduced income real estate generally isn't required as a lot of low revenue real estate units are rented and not possessed by the occupant. The owner of the units can certainly acquire home mortgage defense for reduced revenue real estate unit occupants if the policy is structured properly. In order to do so, the residential property owner would certainly require to function with an independent representative than can structure a group plan which enables them to combine the passengers on one policy.

If you have inquiries, we very suggest consulting with Drew Gurley from Redbird Advisors. Drew Gurley belongs to the Forbes Money Council and has actually functioned a few of the most special and varied home mortgage protection strategies - protection mortgage insurance. He can certainly help you believe with what is needed to put this sort of strategy with each other

Takes the uncertainty out of securing your home if you die or become impaired. Cash goes right to the home mortgage business when a benefit is paid out.

Latest Posts

Final Burial Expenses

Funeral Insurance Compare

Burial Insurance For Senior